In a dynamic quarter marked by shifting demands in the electronics industry, semiconductor foundries grappled with a mix of challenges and opportunities, as reported by TrendForce.

Here are the key highlights of Q2 and a glimpse into what the future holds for major players in the field:

Shift in Demand and Last-Minute Orders Propel Q2 Revenue:

TrendForce’s report reveals an intriguing shift in the electronics landscape, with dwindling inventories of TV components and a surging mobile repair market driving demand for Touch and Display Driver Integration (TDDI) components. These dynamics led to a flurry of last-minute orders, providing a lifeline for semiconductor foundries in Q2. However, experts caution that this adrenaline rush may be short-lived.

Staple Consumer Products Face Sluggish Demand:

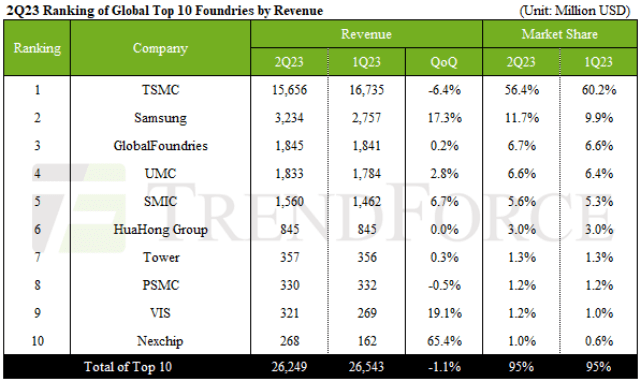

Demand for essential consumer products like smartphones, PCs, and notebooks remained sluggish, leading to a contraction in the use of advanced manufacturing processes. Even traditionally stable sectors like automotive, industrial control, and servers experienced inventory correction, resulting in a sustained revenue decline for the top ten semiconductor foundries.

TSMC’s Q2 Revenue and Hope for Q3:

TSMC, a semiconductor titan, reported a Q2 revenue of $15.66 billion, limiting the quarterly downturn to 6.4 percent. While the 7/6 nm manufacturing processes performed well, the 5/4 nm sectors witnessed a contraction. TSMC anticipates a boost in Q3 with the iPhone’s production cycle and the introduction of the 3 nm process, potentially leading to a rebound in revenue.

Samsung’s Strong Q2, but Challenges in Q3:

Samsung’s foundry business posted a robust Q2 revenue of $3.23 billion, a 17.3 percent QoQ leap. However, Q3 may be affected by a sluggish economy, driving down demand for Android smartphones and other devices. The utilization rate for 8-inch fabs is also declining, although hopes are pinned on Apple’s new device inventory buildup.

GlobalFoundries Holds Steady:

GlobalFoundries maintained stability in Q2 with a nominal revenue increase of 0.2 percent to approximately $1.85 billion. Long-term contracts in specialized niches and automotive-related orders are expected to support the company’s revenue in Q3.

UMC’s Windfall in Q2 Faces Challenges in Q3:

UMC experienced a Q2 revenue boost of 2.8 percent QoQ, driven by emergency orders for TV and Wi-Fi SoCs. However, Q3 poses challenges as consumer spending remains subdued, and emergency orders start to decline.

SMIC Embraces Challenges and Opportunities:

SMIC reported a 6.7 percent QoQ revenue surge in Q2, primarily driven by domestic substitutions in specialized chips. Despite an uncertain 2023, SMIC’s shipments and capacity utilization are expected to continue improving in Q3.

Nexchip’s Remarkable Comeback:

Nexchip made a remarkable comeback in Q2, with revenue soaring by 65.4 percent QoQ, reaching $268 million. Last-minute orders for LDDI and TDDI components, along with high-margin products using the 55 nm process, contributed to this growth. Nexchip is expected to sustain this momentum in Q3, driven by domestic substitution trends in China and new offerings from CIS clients.

Outlook for Q3 and Beyond:

Looking ahead to Q3, seasonal demand is projected to be softer than in previous years. Anticipated orders for premium mainstream chips and high-end HPC AI chips are expected to boost capacity utilization metrics for Apple’s supply chain partners. TrendForce predicts a rebound in the revenue of the top ten global semiconductor foundries in the third quarter, with gradual growth thereafter.