There will be a significant upsurge in the US Fixed-Mobile Convergence (FMC) revenue, escalating from $50.8 billion in 2023 to an impressive $58.8 billion by 2028, the recent analysis by GlobalData said. This growth trajectory, approximating a Compound Annual Growth Rate (CAGR) of 2.97 percent, stems from a convergence of factors driving subscriber adoption.

The driving force behind this expansion lies in the substantial uptake of cellular services provided by cable operators, complemented by the aggressive expansion of high-speed wireless and fiber-optic broadband coverage by telecommunications companies.

GlobalData’s United States Multiplay Forecast-Q3 2023 highlights a contrasting trend. It predicts a decline in total multiplay service revenue within the US at a CAGR of -1.25 percent, slipping from $95.3 billion in 2023 to $89.5 billion in 2028. This phenomenon can be attributed, in part, to a shift in consumer behavior, specifically cord-cutting and cord-shaving, as households pivot from traditional linear pay-TV to streaming services.

Understanding Fixed-Mobile Convergence (FMC)

FMC pertains to households subscribing to bundled services from a single provider. These bundles encompass one or more fixed services like voice, broadband, and pay-TV, alongside one or more mobile services. Typically, these bundles revolve around fixed broadband and may include additional services such as mobile, fixed voice, or pay-TV.

Industry Titans and Their Influence

The surge in FMC revenues and household penetration in the US is significantly bolstered by substantial gains in mobile subscribers by major cable entities like Comcast and Charter. Additionally, leading telcos including Verizon, T-Mobile US, and AT&T are contributing to FMC’s momentum through the adoption of fixed wireless access (FWA) services.

Transforming Landscape of Multiplay Services

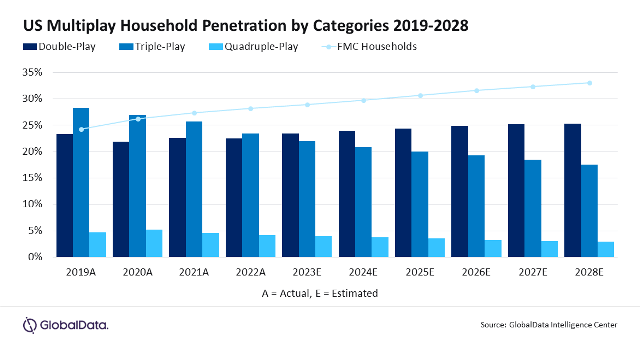

The landscape of multiplay services is experiencing a transformation. Doubleplay services are expected to dominate US household penetration, reaching the 25 percent mark by 2028. However, the trajectory for tripleplay and quadplay services shows a decline. Tripleplay penetration, for instance, is projected to dwindle from 28 percent in 2019 to 18 percent by 2028.

Evolution of Multiplay Strategies

Traditionally, multiplay strategies revolved around offering an array of services to consumers, with quadplay evolving from the conventional tripleplay of fixed broadband, voice, and pay-TV. Yet, the focus is now shifting towards broadband, with consumers embracing over-the-top communication and entertainment services available via the internet.

The Paradigm Shift: ‘Skinnier’ Bundles with Enhanced Connectivity

This shift presents a new paradigm, focusing on ‘skinnier’ bundles that prioritize the capacity of the bundle in terms of data speeds or mobile data allowances. The aim is to offer an ‘always connected’ experience, aligning with the changing demands of consumers engaging with digital services.