The Ericsson Mobility Report Business Review 2024 has identified the latest strategies of Fixed Wireless Access (FWA) operators.

According to the report, FWA is poised to become one of the most successful 5G use cases, with service provider revenues estimated to reach a staggering USD 75 billion by 2029. This growth is fueled by advancements in infrastructure and the evolution of 5G, offering a promising opportunity to address the connectivity needs of over 1 billion households and businesses currently lacking access to broadband services.

Successful FWA operators have leveraged innovative deployment strategies to capitalize on this burgeoning market. Key among these strategies is the implementation of speed-tiered plans, catering to the diverse needs of consumers and businesses for fast and reliable broadband connectivity.

The expansion into FWA represents an estimated 20–25 percent of recent revenue growth. In addition, 5G brings cost efficiencies by reducing energy consumption and supporting service providers to manage increasing data traffic volumes, which will be vital to profitable growth.

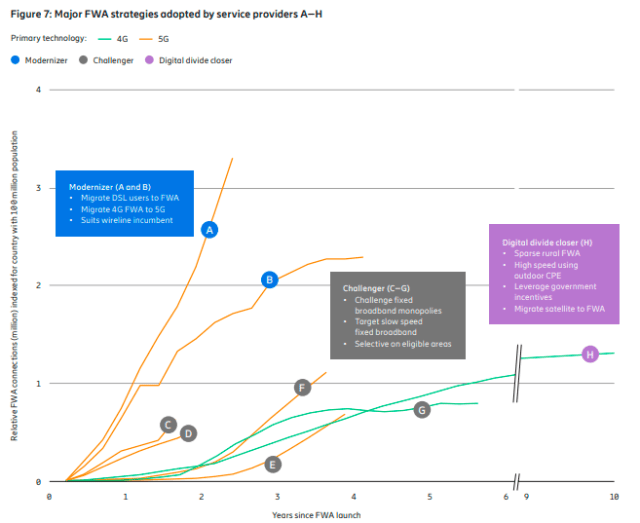

Among the global service providers that have embraced 5G FWA, a select few have emerged as frontrunners, significantly scaling up their customer base within 2 to 4 years. These operators have strategically deployed three primary FWA deployment strategies based on their assets and market dynamics:

Migrate and Retain Customer Base: Modernizers, typically converged service providers with legacy xDSL networks, are leading the charge in migrating subscribers to FWA. By doing so, they reduce operational expenses, retain customers, and upsell higher-speed broadband packages. This approach prioritizes the retention and conversion of existing customers, resulting in a rapid adoption curve.

Capture Fixed Broadband Adjacency: Challengers, including mobile-only providers or converged service operators, focus on upgrading subscribers with slow-speed broadband to high-speed 5G FWA. This strategy introduces competitive pricing and targets regions with limited fixed broadband options, offering consumers a viable alternative.

Focus on Unserved Areas: Digital divide closers concentrate on bringing high-speed broadband primarily to rural and underserved areas. These operators deploy FWA networks to bridge the digital gap, ensuring connectivity for remote communities.

Besides revenue growth, FWA offers operational benefits and smart capital allocation opportunities for service providers. By reducing energy consumption and maintenance costs, operators with legacy copper-based fixed broadband networks can optimize operational expenses. Furthermore, bundling FWA with mobile broadband enhances subscriber acquisition and reduces churn, while migrating 4G FWA traffic to more efficient 5G FWA lowers costs per gigabyte.

To date, around 290 5G networks have been launched commercially, of which more than 40 service providers are offering services based on the more advanced 5G standalone (SA) technology. G subscription uptake has reached 1.6 billion, representing 18 percent of all mobile subscriptions.

In 2023, the 5G penetration of mobile broadband subscriptions in North America surpassed 60 percent and Fixed Wireless Access captured over 90 percent of fixed broadband net additional subscriptions, the report said.

An Ericsson study of retail packages offered by 310 service providers in over 100 countries shows that using speed-tiered pricing models for FWA is increasingly popular. Currently, there are two main FWA pricing plan models, both centered on speed – typical and tiered.