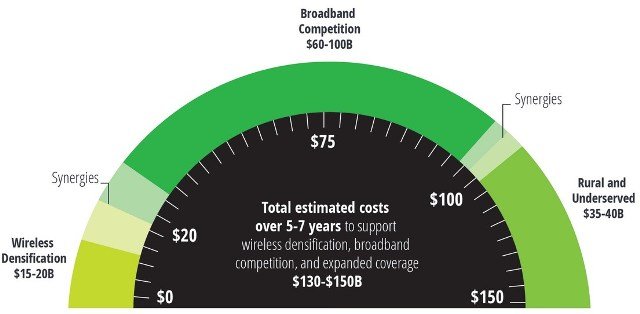

Investment in deep fiber for taking the access network closer to the end customer can unlock the potential of the opportunities in 5G mobile network, while also enhancing broadband competition and rural broadband coverage, Deloitte said.

“We see a 5G ready U.S. infrastructure as critical to enabling a range of other adjacent industries to compete globally and safeguard our digital economy,” said Craig Wigginton, vice chairman and telecommunications sector leader, Deloitte & Touche.

Investment in deep fiber will be critical for carriers to support the projected 4-fold increase in mobile data traffic between 2016 and 2021.

Deep fiber deployment will increase choice of broadband service for residential customers. Fiber will also be key for the national infrastructure imperative to provide high-speed broadband connections to consumers in both rural and cities.

“It is essential that fiber gets deployed closer to the customer to enable next generation wireless and to ensure affordable high speed connectivity across urban, suburban and rural geographies,” said Dan Littmann, principal, Deloitte Consulting.

The report said fiber currently passes less than one-third of U.S. homes, and only 39 percent of consumers have access to more than one broadband provider of at least 25 megabits per second (Mbps) service.

Approximately 10 million rural homes and 3 million urban/ suburban homes do not have broadband of at least 25 Mbps. In rural communities, only 61 percent of the population has access to 25 Mbps wireline broadband, and when they do, they can pay as much as three times more than suburban customers.

Failure to motivate investment in deep fiber could result in negative consequences, including insufficient network densification to support wireless traffic growth, 5G deployment and associated use cases, lack of choice for consumer broadband, and the widening of the digital divide.

Carriers could enhance their ability to realize cost savings by adhering to a transformation program that creates industry standards for IP product mapping to substitute legacy products, and investing in digital processes aimed at faster product development and provisioning.

IP migration and regulatory reforms will not be enough to create the case for fiber deployment. Wireless, wireline and cable require creative new ways to monetize “last mile” access as an incentive for massive fiber deployment.

New business models in fiber

Gartner predicts that affluent households will have up to 500 connected devices by 2022. In some cases, IoT services offer new revenue.

Most connected devices will require low bandwidth or be WiFi enabled and may not provide carriers with incremental revenue. In such cases, carriers have an opportunity to increase revenue by offering integration, network security, and traffic management services within the complex mix of IoT devices and ecosystems.

There can be partnership between carriers and OTT players to fund deep fiber investment. Over the top (OTT) players may select to fund fiber deployment, including owning assets or forming partnerships with carriers.

As interest grows from nontraditional fiber investors, shared infrastructure models will emerge for last mile fiber access. Fiber as leased real estate could allow carriers to maximize asset utilization.