There will be a steady increase in India’s total revenue from telecom and pay-TV services, GlobalData said in its latest research report.

The India Telecom Operators Country Intelligence Report by GlobalData reveals that mobile voice service revenues are expected to decline during the forecast period. This decline is driven by a gradual reduction in mobile voice service Average Revenue Per User (ARPU), as users increasingly shift to Over-The-Top (OTT) communication platforms.

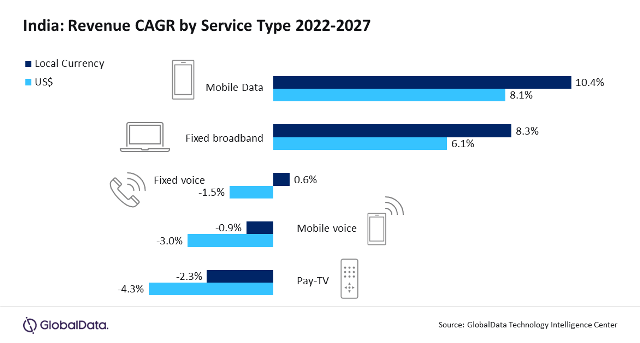

However, the report highlights the contrasting growth in mobile data service revenues, projecting an impressive CAGR of 8.1 percent over the forecast period. This growth is attributed to the continuous rise in smartphone adoption, an increase in mobile internet subscriptions, and the growing consumption of mobile data services. This trend is further boosted by the expansion of the 4G subscriber base and the projected adoption of higher Average Revenue Per User (ARPU) 5G services.

Sarwat Zeeshan, a Telecom Analyst at GlobalData, emphasized that 4G services maintained the majority share of mobile subscriptions in India in 2022 and are expected to remain the leading mobile technology by subscriber volume until 2027. Nevertheless, 5G subscriptions are projected to grow at a faster rate, driven by increasing demand and the availability of high-speed 5G services. Major telecom operators like Airtel aim to extend their 5G coverage to a substantial number of villages by 2023 and achieve nationwide coverage by March 2024.

In the fixed communication services segment, the report predicts a decline in fixed voice service revenues due to losses in circuit-switched subscriptions and decreasing fixed voice ARPU. However, fixed broadband service revenues are anticipated to rise at a CAGR of 6.1 percent from 2022 to 2027. This growth aligns with the steady increase in fixed broadband subscriptions, particularly over Fiber to the Home/Building (FTTH/B) access lines.

Zeeshan also highlighted that the growing demand for higher-speed fiber broadband connectivity, driven by government efforts to expand fiber network infrastructure across the country, will stimulate the adoption of fiber broadband services. Notably, the government has approved $17.4 billion for the final phase of the last-mile optical fiber-based broadband connectivity plan, covering 640,000 villages under the BharatNet project in the next two years.

In the pay-TV service sector, revenues are expected to decline over the forecast period due to the ongoing decrease in cable TV, Direct-to-Home (DTH), and Internet Protocol Television (IPTV) subscriptions. Falling pay-TV ARPU levels result from users migrating to OTT-based video service platforms.

Reliance Jio led the mobile services segment in terms of subscriptions in 2022, followed by Airtel India. Reliance Jio is poised to maintain its leading position, thanks to competitively priced 4G packages and its accelerated expansion of 5G services to meet the increasing demand for high-speed services among residential and business customers. The operator also leads the country’s fixed broadband services market in terms of subscriptions, bolstered by its strong position in the growing fiber broadband services segment and efforts to expand its JioFiber network.

The future of India’s telecom and pay-TV industry seems promising, with substantial growth anticipated in mobile data, fixed broadband, and 5G services, in response to the evolving needs and preferences of Indian consumers.