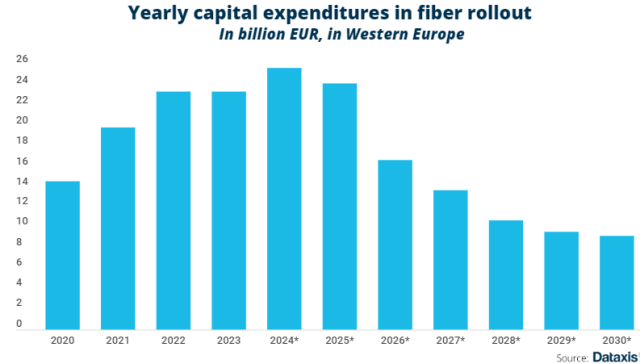

In a significant development, Western Europe is likely to receive a massive investment of 270 billion EUR or US$284 billion for the rollout of full fiber connectivity by the year 2030.

This investment is a key component of the European Union’s ambitious “Digital Decade” initiative, which aims to achieve two major objectives: providing Gigabit network coverage to all European households and extending 5G coverage to all populated areas.

The upcoming year will see a peak in yearly investment, with an impressive cash influx of EUR 25.8 billion dedicated to expanding fiber coverage throughout the region. Notably, Germany and the UK are slated to account for two-thirds of this annual investment, a stark contrast to their 2020 investment, which represented only 30 percent of the total investment in the region, Ophelie Boucaud, Senior Analyst at Dataxis said in its report.

Southern Europe and France Leading the Fiber Rollout

France and Spain are emerging as leaders in the rapid rollout of fiber, with over 80 percent of total premises in these countries expected to be connected to full fiber by the end of the year. Meanwhile, Portugal is already ahead with 90 percent of premises connected to fiber.

In France, efficient coordination by local authorities and collaboration among the main operators has facilitated a faster fiber expansion. As of mid-2023, French operators have collectively connected 36.2 million premises, covering approximately 27.5 million unique premises.

Challenges in Expanding Fiber to Rural Areas

Across various European countries, the focus is shifting towards connecting rural and remote premises, which presents technical challenges and requires substantial investments. The cost per new premise is higher in these areas, and the return on investment decreases compared to densely populated regions.

Differences in Fiber Expansion Strategies

Countries with a historically strong presence of cable companies, such as Germany, the UK, and Benelux, are lagging behind in fiber coverage due to the prevalence of internet cable offers in the broadband market. Expanding fiber to homes is a costly endeavor, representing a significant portion of operators’ capital expenditures for this decade.

Evaluating the Future of Fiber Investments

Investors are relying on revenues from existing network-connected customers to fund further fiber expansion, but challenges are surfacing. In the UK, several alternative networks have announced job cuts and project freezes due to lower-than-expected returns on newly built fiber connections and marketing challenges in migrating customers to new access technology.

Public Investments as a Solution

As fiber rollout progresses, a growing proportion of projects are focusing on rural and remote areas. These areas are expensive and challenging to connect, but they offer fewer incentives for investors compared to densely populated regions. However, dedicated investors are increasingly focusing on greenfield areas and underserved communities, attracting subsidies to drive gigabit connectivity. Initiatives like the Connecting Europe Broadband Fund, supported by the European Investment Bank, are set to invest significant subsidies in fiber expansion across member states.

French authorities have allocated EUR 240 million to boosting rural connectivity as part of their Recovery and Resilience Plan.

Last August, Spanish authorities have launched the third call for their UNICO Broadband program and are about to invest EUR 150 million in fiber expansion to rural areas.

In Switzerland, where public funds haven’t been committed to the broadband sector up to this point, a discussion is emerging. A report from the Federal Council highlighted that private ISPs would only invest in fiber rollout in regions where it is financially viable.

The cost of connecting new premises is by far the highest in Switzerland and return on investments are limited because of the country’s landforms situation. The report commissioned by Swiss authorities estimates that in 75 percent of cases, rural fiber rollout would not be profitable for the private sector and recommends a public investment of at CHF 3.8 billion.