Asia-Pacific’s fixed communications service revenue is anticipated to experience a steady rise, with a CAGR of 1 percent, projecting an increase from $368 billion in 2023 to $386.9 billion in 2028, according to projections by GlobalData.

As of the end of 2023, the Asia-Pacific region demonstrated moderate development in fixed broadband adoption, with a penetration rate reaching 21.1 percent of the population.

GlobalData forecasts a surge in fixed broadband penetration to 23.3 percent by 2028, fueled by expansions of broadband networks and increased service adoption, particularly in emerging countries such as India, Indonesia, the Philippines, and Thailand.

Governments in these emerging countries are injecting substantial investments into fixed broadband network infrastructure development plans.

In Thailand, the Village Broadband Internet initiative, known as Net Pracharat, has provided free broadband internet to approximately 74,987 villages, benefiting over 10.48 million rural residents as of January 2024. The project’s goal is to boost the digital economy from 12 percent to 30 percent of GDP by 2027.

India plans $13 billion investment in broadband to make sure high quality broadband internet reaches each and every corner of the country.

A World Bank report says internet in Indonesia is relatively expensive and slow. Indonesia records the second slowest mobile broadband (17.24 Mbps) download speed.

Fixed communication services revenue in the Philippines is expected to increase at a CAGR of 5.2 per cent from US$3.8 billion in 2023 to US$4.9 billion in 2028.

In the Philippines, PLDT plans to invest a Capex of around PHP80 billion to PHP85 billion (US$1.5 billion to US$1.6 billion) in 2023 and seeks to upgrade and expand its fibre broadband network and gain from wider coverage of its FTTH services.

Contrastingly, developed Asian countries like Australia, New Zealand, and Singapore already boast high broadband penetration, courtesy of national broadband network (NBN) projects.

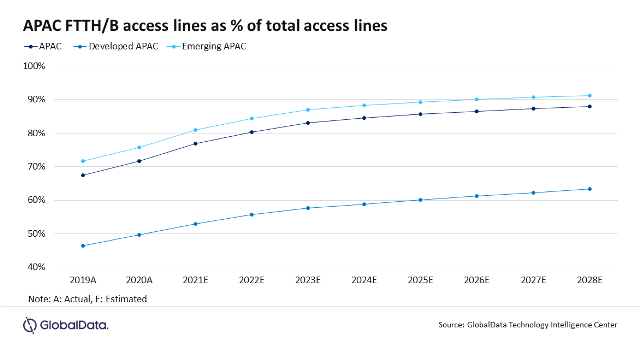

The growth in the Asia-Pacific fixed broadband services market is expected to be spearheaded by the fiber broadband segment, with fiber-optic access lines projected to constitute approximately 63 percent of total fixed access lines in the developed APAC region by 2028. Meanwhile, emerging markets are poised to witness a higher share at 91 percent.

Fueled by a surging demand for high-speed internet services and competitively priced fiber broadband plans, the adoption of fiber broadband services is set to rise. Key operators, including Reliance Jio India, Spark New Zealand, and Telstra Australia, enhance the allure of fiber plans by bundling them with value-added services such as subscription video on demand (SVoD) and pay-TV.

For example, Reliance Jio’s broadband plans in India offer unlimited data at speeds ranging from 30 mbps to 150 mbps, coupled with access to popular OTT platforms like Amazon Prime Video, Disney + Hot Star, VooT Select, Zee5, and SonyLIV.

China stands out as a major player in the fiber broadband market, with approximately 98 percent of its broadband subscriptions utilizing fiber optic lines as of 2023. The country’s Telecom regulator MIIT has reported significant progress, connecting about 110 cities with gigabit fiber networks by February 2023.

Similarly, Singapore is poised to witness FTTH/B accounting for nearly 100 percent of broadband lines by 2028, propelled by robust investments and an aggressive approach by NetLink NBN Trust in fiber broadband network expansions.

While voice telephony penetration in the Asia-Pacific region is expected to remain stagnant at around 10 percent throughout the forecast period, there will be a shift in technology. Circuit switched telephony lines are projected to decline at a CAGR of 5.8 percent, while packet switched telephony lines will experience growth at a CAGR of 3.6 percent, driven by various fiber roll-out programs encouraging consumers to switch to Voice over Internet Protocol (VoIP).

Despite the overall increase in voice telephony access lines, fixed voice revenue is anticipated to decline over the forecast period due to the rising prevalence of mobile voice and over-the-top (OTT) voice usage.

Baburajan Kizhakedath