Telecom industry analysts believe that Nokia Networks is missing out to its main rival Ericsson due to its weak acquisition policy.

Ericsson made several acquisitions in the recent past.

Some of the major acquisitions by Ericsson include Red Bee Media (May 2014), Azuki Systems (February 2014), Microsoft Mediaroom (September 2013), ConceptWave (September 2012), Technicolor Broadcast Services Division (July 3, 2012), BelAir Networks (April 2012), Telcordia (October 2011) and Optimi (2010).

Recently, Nokia CEO Rajeev Suri announced that the company will make investments to support the company’s long term growth plans.

Besides NSN exiting from several telecom segments as part of its major reshuffling, Nokia has divested wireless modem business and MetaCarta’s enterprise business in 2010.

Wireless network infrastructure assets of Motorola Solutions were one of the key acquisitions made by NSN.

Michael Soper, telecom analyst, TBR says Nokia is unlikely to leverage the cash to make a strategic acquisition, but the company’s willingness to spend on tuck-in acquisitions is a positive development.

Nokia is flush with cash following the April closing of its sale of the Devices & Services business to Microsoft for €5.4 billion (or $7.5 billion). Nokia is using about €5 billion (or $6.8 billion) to return cash to shareholders through dividends and share repurchases and to pay down its debt.

During restructuring and much of its existence as a joint venture with Siemens, the Networks business was largely unable or unwilling to indulge in acquisitions due to NSN’s unprofitability.

“The lack of acquisition activity put the company at a disadvantage when competing with a deep-pocketed rival such as Ericsson. Nokia will continue making tuck-in acquisitions, primarily to enhance its Mobile Broadband segment,” Soper added.

Nokia Networks made its first acquisitions since entering restructuring in 2011, buying compact radio systems company Mesaplexx, wireless deployment specialist SAC Wireless, and a geo-location solution from NICE Systems.

In fact, NSN sold several businesses including WiMax as part of its restructuring.

The report said Nokia Networks has proven it can achieve consistent profitability and is primed to capitalize on growth opportunities in H2 2014.

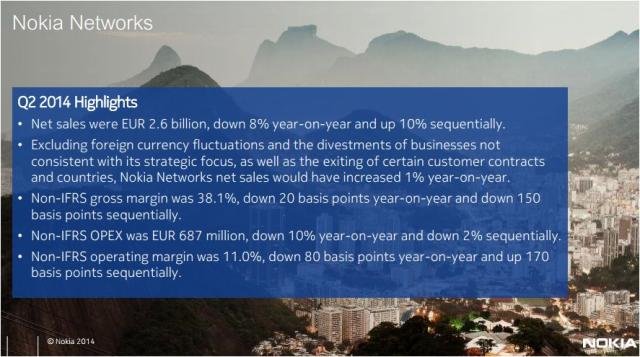

The restructured Nokia Networks reported vastly improved financial results in Q2 2014 and TBR believes the company’s year-long run of operating margins above 5 percent will continue through 2015. Nokia Networks achieved a company-record operating margin of 9.1 percent in Q2 2014 as the business mix improved, with increasing Mobile Broadband sales and lower services revenues.

As the impact of divestitures and contract exits is mitigated by the passage of time, Nokia Networks will see revenue growth driven by LTE deployments in China (China Mobile and, to a lesser extent, China Telecom) and from Sprint in the U.S. The ramp-up of the Sprint contract will more than offset the concluding T-Mobile USA contract, which began to wind down in H2 2013.

Nokia Networks’ China Mobile contracts will spur total revenue growth in H2 2014, without harming margins.

Nokia Networks’ participation in China Mobile’s ongoing LTE rollout led to a 17.7 percent year-to-year increase in China revenue, but total company revenue continued to fall. TBR expects the second phase of China Mobile’s LTE deployment to help Nokia reverse this trend beginning in Q3 2014.

In phase two, Nokia is deploying TD-LTE infrastructure to 18 of China Mobile’s 31 operating markets and secured the leading share of all vendors outside of China-based suppliers Huawei and ZTE. TBR expects China revenues to increase over 20 percent year-to-year in Q3 2014, spurring low single-digit company revenue growth.

Nokia’s increased deployments for China Mobile have not hurt gross margin to the extent that had been expected. Gross margin declined just 20 basis points year-to-year, partially due to the lower RAN prices offered to China Mobile.

However, Nokia is providing fewer low-margin network rollout services to the operator than is typical of such equipment supply contracts. In addition to the LTE vendors, China-based services firms are deploying portions of China Mobile’s network.

Baburajan K

editor@telecomlead.com