Care Ratings Chief Economist Madan Sabnavis and Research Analyst Bhagyashree C Bhati have explained why India is not ready for making investment in 5G networks in the short term.

The Care Ratings report said the 700 MHz band is being used worldwide for deployment of 4G mobile and evolution of 5G services. Indian telecoms are not equipped with 700 MHz, the most efficient band for 4G services, and getting ready for 5G services in this case seems to be a tough task.

First, Indian telecom operators do not have 700 MHz spectrum because they did not buy this spectrum for 4G mobile services at a reserve price of Rs 11,475 crore during the spectrum auction in October 2016.

The demand was nil in October 2016 because Indian telecom operators would have to pay Rs 57,375 crore to buy a minimum block of 5 MHz as per the spectrum guidelines prescribed by TRAI that time.

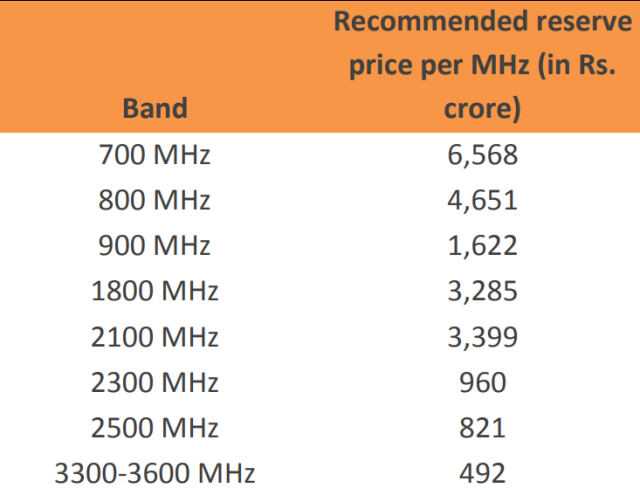

Spectrum Reserve Price per MHz

700 MHz — Rs 6,568 crore

800 MHz — Rs 4,651 crore

900 MHz — Rs 1,622 crore

1800 MHz — Rs 3,285 crore

2100 MHz — Rs 3,399 crore

2300 MHz — Rs 960 crore

2500 MHz — Rs 821 crore

3300-3600 MHz — Rs 492 crore

The financial pressure has increased for Bharti Airtel and Vodafone Idea ever since Reliance Jio entered the market in September 2016 grabbing more than 200 million subscribers on its 4G network.

Second, mobile operators will have to pay Rs 32,840 crore to buy a minimum block of 5 MHz as per the revised price of Rs 6,568 crore for buying each unit of 700 MHz band. Though the price has been slashed by 42.7 percent as compared to the earlier reserve price of Rs 11,475 crore, the demand seems to be negligible considering the financial health of the industry.

Third, TRAI has suggested a reserve price of Rs 492 crore for 5G spectrum under 3300-3600 MHz band. Telecom operators will be forced to spend Rs 9,840 crore to buy this spectrum in the block size of 20 MHz. If the government is not suggesting deferred payment system for 5G, the demand will be bleak. Germany has suggested late payment for 5G spectrum.

At Rs 492 crore per MHz, 5G spectrum in the 3300-3600 MHz band is the cheapest spectrum available in India. The telecom regulator has kept the price low because telecoms will need more spectrum to ensure better coverage for 5G services.

Fourth, TRAI recommended that there will be no roll out obligations for spectrum in 3300-3600 MHz band as part of the strategy to attract bidders for the 5G spectrum. This guideline will not encourage telecom operators because their fiber investment will not be enough for 5G coverage in dense pockets.

5G connection in India, according to a latest research report, is expected to generate $20 billion revenue for telecom companies by 2025. India mobile companies are looking to provide high HD premium videos to their users on their 5G networks.

“The new TRAI policy recognises that for India to have an early advantage on 5G deployment, it requires an extensive fiberization program and this needs to be undertaken by telcos,” Ashish Sharma, partner – Telecom, PwC Strategy, said.

“However the financial strength of the sector is still in transition and therefore the sector’s ability to do so is a question which needs to be addressed first. In any case, the spectrum auction is a bit early, given that we have yet to get ubiquitous fibre and 4G roll out,” Ashish Sharma said.

Fifth, India does not have a strong telecom operator like T-Mobile US, which has the financial backing of Deutsche Telekom of Germany, to sign a $3.5 billion or INR 24,000 crore plus deal to buy 5G equipment from Nokia.

Indian telecom operators purchased around 965 MHz that equals to 41 percent of the spectrum that was available for purchase during the last auction held in October 2016. This indicates that Indian mobile operators need more time to improve their financial issues and start spending on spectrum.

Telecom companies opted for spectrum in 1,800 MHz, 2,300 MHz and 2,500 MHz bands for their 4G services and did not buy spectrum in the costly 700 MHz and 900 MHz bands in October 2016.

Baburajan K