Verizon has revealed that its Capex for 2023 will be significantly lower as compared with previous year — despite 5G network expansion.

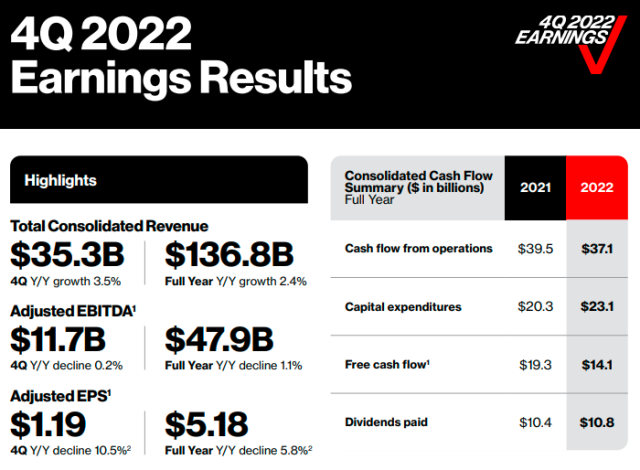

This compares with Verizon’s full-year 2022 capital expenditures of $23.1 billion, including C-Band spending of $6.2 billion. Verizon has already shut down its 3G network.

Capital spending for the year totaled $23.1 billion, an increase of $2.8 billion compared to 2021. This increase was driven entirely by C-Band spectrum build-out which totaled $6.2 billion in 2022, up from $2.1 billion in 2021, while business-as-usual capital spending declined by $1.3 billion to $16.9 billion in 2022.

C-Band-related investments peaked in 2022, and we expect capital intensity to begin to decline in 2023 with less than $1.8 billion remaining to complete the incremental $10 billion of C-Band-related capital spending that we announced at our 2021 investor day, Verizon said.

Verizon said the focus in 2023 will be on unlocking further synergies from the integration of TracFone by shifting TracFone customers on other carriers’ networks onto Verizon’s network. 81 percent of TracFone customers were on Verizon’s network in 2022, an improvement from 68 percent in 2021. Verizon aims to complete the majority of the migration by the end of 2023.

Verizon Chairman and CEO Hans Vestberg said: “We are rapidly building out our C-Band spectrum with the most aggressive network deployment in our company’s history and are well positioned to improve and accelerate our performance. Wireless mobility and nationwide broadband will be two of the most significant contributors to our growth for the next several years.”

Verizon is aiming for wireless service revenue growth of 2.5-4.5 percent with Adjusted EBITDA of $47-$48.5 billion in 2023.

Verizon today reported operating revenue of $35.3 billion in the fourth-quarter of 2022, up 3.5 percent from the fourth-quarter of 2021. Revenue growth in Q4 2022 was driven by service and other revenue and equipment revenue.

Verizon’s full-year 2022 operating revenue rose 2.4 percent to $136.8 billion. Verizon did not reveal the impact on revenue due to its investment in 5G network during the year.

Verizon does not reveal its 5G subscriber base for 2022 and target for 2023. The company has added 217,000 net new monthly bill paying wireless phone subscribers in the fourth quarter. Verizon added 558,000 subscribers in the fourth quarter last year.

Verizon’s Consumer business reported 41,000 wireless retail postpaid phone net additions in fourth-quarter 2022. Verizon’s Consumer business ended fourth-quarter 2022 with 59 percent of its postpaid wireless phone customers having 5G-capable devices.