Maxis has revealed that the company’s revenue, EBITDA, EBITDA margin and net profit have dropped in the first quarter of 2019.

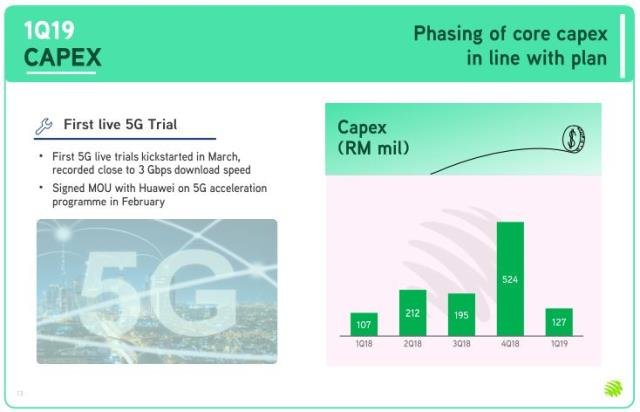

Capex fell to RM127 million as against RM524 million in Q4 2018, due to phasing of Capex as Maxis continued its special focus on planning and tendering for the investment in network capacity to support data traffic growth, investment in Home Fibre and Enterprise growth.

Maxis added 31,000 new fibre broadband subscribers in Q1.

Maxis has signed agreement with Huawei for 5G acceleration program and started first 5G live trials in the country, recording close to 3Gbps download speed with test user equipment.

Maxis said it will not be increasing its Capex despite the 5G investment. The base Capex of Maxis in the next three years will be RM 1 billion per year and the growth Capex will be RM 1 billion in three years.

Maxis said its 4G LTE network delivered download speed of more than 5 Mbps 91 percent of the time in key market centres, achieving 93 percent population coverage. Data consumption rose 7.1 percent to 11.7GB per month in Q1 2019.

Service revenue dropped 1.7 percent to RM 1,947 million largely due to decline in prepaid users, reduction in ARPU, and termination of a network sharing agreement.

Post-paid service revenue grew 1.5 percent to RM 1 billion supported by increase in subscriber base of 349k to 3,261k. Post-paid ARPU fell to RM88 from RM92 in Q4 2018, mainly due to the change in the MTR and ARPU dilution from Hotlink Postpaid Flex offerings.

Pre-paid service revenue dropped 6.1 percent to RM797 million from RM849 million on the back of a lower subscription base which was impacted by the continued SIM consolidation, migration from pre-paid to post-paid, and reduced MTR.

Pre-paid ARPU was RM40 per month thanks to the contribution of mobile internet revenue. Maxis has invested in data analytics for segmental and personalised offerings, which attracted high data users.

Baburajan K