Global IoT connectivity revenues rose 24 percent to €10.8 billion in 2022 as the decline in the global ARPU decelerated, Berg Insight said.

The ARPU from IoT connectivity business dropped 1 percent to €0.38.

IoT connectivity revenues account for about 2 percent of total revenues for the largest mobile operator groups.

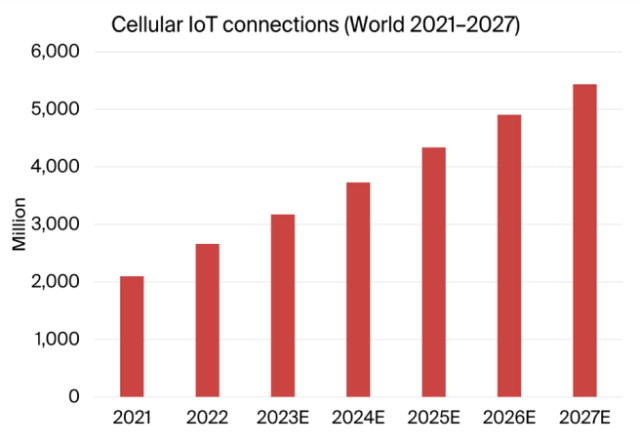

By 2027, Berg Insight projects that there will be 5.3 billion IoT devices connected to cellular networks worldwide, generating annual connectivity revenues of €21.4 billion.

The top ten mobile operators reported a combined active base of 2.3 billion cellular IoT connections at the end of 2022, accounting for 87 percent of the total 2.7 billion connections.

China Mobile is the world’s largest provider of cellular IoT connectivity services with 1.06 billion cellular IoT connections. China Telecom and China Unicom ranked second and third with 407 million and 390 million connections respectively.

Vodafone ranked first among the Western operators and fourth overall with 160 million connections, followed by AT&T with 107 million in fifth place.

Verizon, Deutsche Telekom and Telefonica had in the range of 36–57 million cellular IoT connections. KDDI and Orange were the last players in the top ten with about 30 million each.

In Western markets, IoT managed service providers play a key role in the ecosystem. Most players operate as full MVNOs, typically offering IoT connectivity services based on a mix of roaming and local access agreements and sometimes also value-added services targeted at vertical segments. Notable examples include Velos IoT, Aeris, KORE Wireless, 1NCE and Wireless Logic. Altogether, IoT managed service providers had more than 150 million cellular IoT connections under management at the end of 2022 and around € 1.5 billion in annual revenues.

IoT subscribers

The number of cellular IoT subscribers reached a staggering 2.7 billion at the end of 2022, marking a remarkable 27 percent increase from the previous year. This significant growth indicates that around 24 percent of all mobile subscribers have now adopted IoT technology.

The number of cellular IoT subscribers will reach 5.4 billion by the end of 2027 at a compound annual growth rate (CAGR) of 15.4 percent.

Cellular IoT connectivity revenues are projected to soar, experiencing a CAGR of 14.6 percent during the same period, which will lead to approximately €21.4 billion in revenues by 2027. However, the monthly ARPU is expected to decrease to €0.35.

China’s installed base of IoT connections grew by an impressive 32 percent in 2022, reaching 1.8 billion connections, accounting for about 70 percent of the global installed base, according to data from the country’s national telecom regulator.

North America and Western Europe follow as the second and third largest markets for IoT solutions, boasting 240 million and 218 million IoT subscribers, respectively, by the end of 2022.

The connected car is identified as one of the strongest trends in these regions, with nearly 90 percent of new cars sold featuring embedded cellular connectivity. Other key application areas include fleet management for commercial vehicles, smart utility metering, and monitored alarm systems.

Latin America, Central & Eastern Europe, South Asia, the Middle East, Africa, and Southeast Asia fall within the range of 11 to 62 million IoT subscribers. Australia & Oceania hold the smallest region with approximately 11 million connections.

China Mobile emerges as the leader with 1.06 billion cellular IoT connections and a growth rate of 32 percent. China Telecom and China Unicom follow closely in second and third place with 407 million and 390 million connections, respectively.

Vodafone ranks as the top Western operator and fourth overall with 160 million connections, followed by AT&T with 107 million in fifth place. Other notable players include Verizon, Deutsche Telekom, Telefonica, KDDI, and Orange.

IoT connectivity revenues are growing at a slower pace than the number of connections. The global ARPU decline slowed in 2022. Mobile operators are shifting their focus towards value-added services to boost their IoT portfolios, including cloud services and security capabilities.

Vertical integration strategies, such as acquiring local solution providers in areas like fleet and asset tracking, are also gaining popularity. Private LTE/5G is becoming an emerging focus area, with many operators acting as managed service providers.

China Mobile secured the highest IoT connectivity revenues of €2.2 billion in 2022 but reported one of the lowest monthly ARPU of €0.19. China Unicom achieved €1.2 billion in IoT sales for the year, with the highest growth rate of 42 percent.

AT&T and Vodafone are believed to have generated IoT connectivity revenues in the range of €1.1 billion and €0.9 billion, respectively. Verizon, on the other hand, generated annual IoT revenues of more than US$1.5 billion (€1.4 billion), with the majority originating from the Verizon Connect fleet management and telematics business. The annual IoT connectivity revenues for other operators range from €700 to €750 million.

The future of cellular IoT appears promising as the industry continues to evolve, driven by innovative technologies and strategic partnerships across the globe.