The global private mobile network market continues its strong growth, fueled by expanding deployments of LTE and 5G across industries and regions.

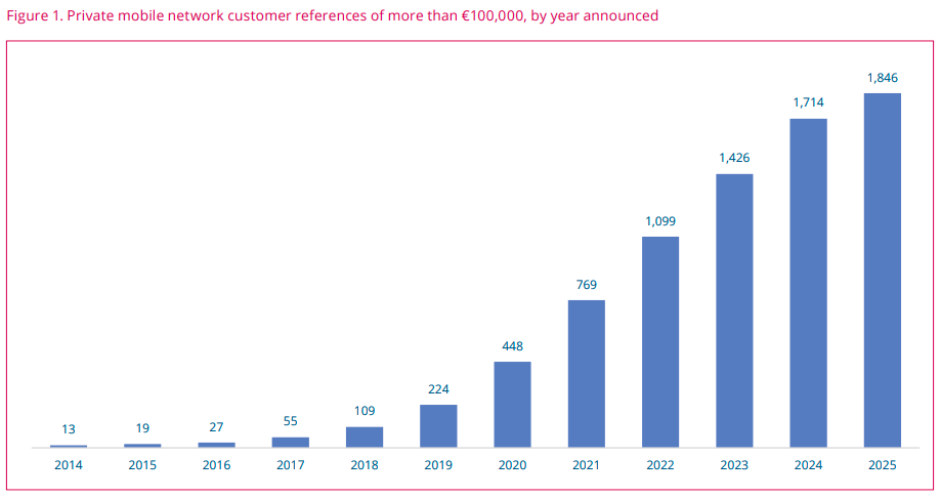

According to the Global mobile Suppliers Association (GSA), total private mobile network customers reached 1,846 by the second quarter of 2025, adding 74 new references valued at over €100,000. This represents a steady rise from 1,772 customers in Q1 2025 and reflects a 63 percent CAGR in customer announcements from 2017 to 2024.

Diverse Ecosystem Driving Growth

Private mobile networks are supported by a broad range of stakeholders, including equipment vendors, mobile network operators, system integrators, consulting firms, and software core vendors. More than 50 equipment vendors now supply LTE and 5G solutions, with pre-integrated offerings simplifying adoption since 2021. GSA has identified over 66 telecom operators engaged in private network projects, while hyperscalers such as global cloud providers are increasingly partnering with operators to deliver scalable solutions using their vast infrastructure.

LTE and 5G Deployments

Of the documented customers, 1,293 use LTE, while 876 (47 percent) are deploying 5G, marking a gradual shift toward next-generation networks. Although many 5G deployments remain long-term trials or limited to research facilities, this transition highlights the growing role of 5G in industrial and enterprise operations. The share of LTE-only networks dropped slightly from 51.7 percent in Q1 2025 to 51.1 percent in Q2 2025, as companies explore 5G upgrades and multi-site expansions.

Industry Leaders in Adoption

The manufacturing sector leads private network adoption with 359 deployments, up from 352 at the start of 2025. Education and academic research follow with 164 networks, while mining (134), defense and peacekeeping (122), device testing and lab-as-a-service (111), and power utilities (103) round out the top five industries. Manufacturing and mining were the fastest-growing sectors in Q2 2025, each adding seven new customer references.

Jiuquan Iron & Steel Co., Ltd (JISCO) deployed a private 5G network in its Xigou Mine in China using Huawei. The network enabled autonomous operation of mining trucks and remote control of excavators, improving operational efficiency and safety by reducing the need for personnel in hazardous areas. Scheduling and coordination of machinery were optimized, while data security and reliability increased due to the isolated private network.

Newmont implemented a private 5G network at its Cadia Mine in New South Wales, Australia, with Ericsson as the vendor. The network reduced downtime by allowing operators to work remotely and supported connectivity for multiple heavy equipment units. This deployment improved safety, increased operational efficiency, and simplified network setup, enabling faster scaling of remote operations.

CJ Logistics in Icheon, South Korea, adopted a private 5G network from Ericsson in its warehouse and distribution facility. The network replaced hundreds of Wi-Fi access points with just 22 small cells, reducing infrastructure costs. It improved scanning throughput, accelerated operations by about 20 percent, and provided reliable coverage for handheld devices, mobile robots, and autonomous guided vehicles, enhancing overall productivity.

Geographic Expansion

Private mobile networks are now present in 80 countries and territories, with the United States, Germany, the United Kingdom, China, and Japan hosting the most deployments. Australia posted 14 percent growth quarter-over-quarter, while Malaysia surged 67 percent and Mexico 57 percent, albeit from smaller bases. The majority of deployments remain concentrated in high- and upper-middle-income regions, strongly correlating with markets that have dedicated spectrum.

Market Outlook

Despite reports of tens of thousands of networks in China, GSA notes many of these rely on public networks and do not qualify as true private deployments. Importantly, 75 percent of all customer references remain non-public, reflecting sensitive industrial and defense use cases. With an expanding ecosystem of vendors, operators, and hyperscalers, the private mobile network market is poised for continued growth as enterprises scale LTE and 5G networks to meet rising connectivity and automation demands.

Baburajan Kizhakedath