Opensignal has released a report examining the performance of 5G network operators across France, comparing against neighboring European markets including Germany, Italy, Spain, Switzerland, and the United Kingdom.

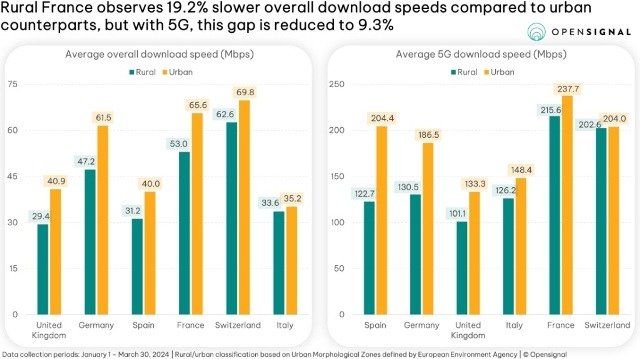

Users in rural France reported 5G download speeds of 53Mbps, exhibiting a 12.6Mbps (19.2 percent) lag behind urban counterparts. This rural-urban disparity in 5G download speeds stood notably higher compared to Italy (4.7 percent) and Switzerland (10.3 percent), but lower than Spain (22 percent), Germany (23.2 percent), and the U.K. (28 percent).

Rural France boasts a 5G download speed of 215.6Mbps, trailing urban areas by 9.3 percent. This places France at the forefront among the examined markets despite its late entry into the 5G business, with all French operators launching 5G services in December 2020. Notably, rural France’s average 5G download speeds substantially outstrip those in urban areas of Germany, Italy, Spain, Switzerland, and the U.K.

Switzerland emerged as the sole other country to witness 5G download speeds surpassing 200Mbps in rural locales. Switzerland’s rural-urban gap in 5G download speed, partially attributable to its 5G launch in April 2019, contrasts sharply with other markets where the gap widens with 5G, ranging from 15 percent in Italy to 40 percent in Spain.

While France leads in urban 5G Availability at 22 percent, its rural areas lag behind at 13.5 percent, marking an urban-rural disparity of 8.5 percentage points, the largest observed across compared markets.

Orange secured €500 million ($530 million) loan from the European Investment Bank (EIB) in February 2023 to bolster 5G infrastructure deployment and enhance 4G networks, particularly in rural regions.

Iliad received a €300 million ($329 million) EIB loan in December 2023 to bolster its 5G network expansion efforts, bringing its total EIB funding since 2009 to over €1.7 billion and achieving a claimed 5G population coverage of over 94.4 percent.

As of April 1, 2024, France boasted 45,065 authorized 5G sites, with nearly 81 percent operational under network sharing agreements between operators, according to data from L’Agence Nationale des Frequences (ANFR).

Free Mobile leads in operational 5G sites, utilizing the 700MHz band, followed by Bouygues and SFR, leveraging mid-bands such as 2100MHz and 3.5GHz. Bouygues and SFR secured approval to deploy 5G on their shared network in July 2023, while Orange predominantly relies on the 3.5GHz band.