Amid extensive 5G network deployment, European telecom operators are anticipated to recalibrate their strategies, focusing on returns on investment and 5G monetization. Forecasts from GSMA report suggest a gradual downturn in capital expenditure (capex) levels as attention shifts towards optimizing existing infrastructure and extending 5G coverage, particularly in rural areas.

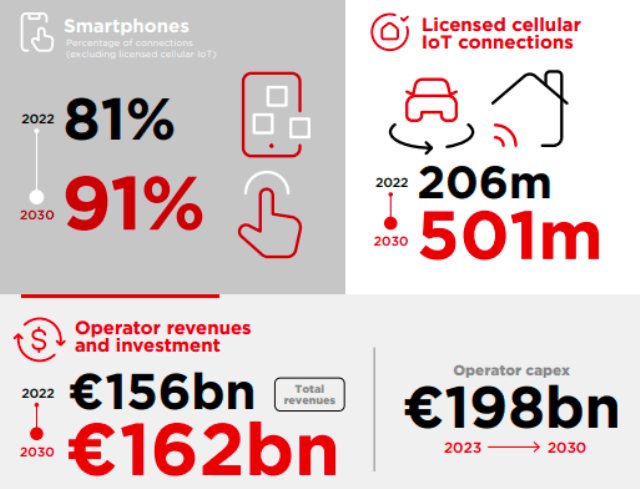

Revenue of mobile operators in Europe is expected to reach €162 billion in 2030 from €156 billion in 2023.

Capex of mobile operators in Europe is expected to reach €198 billion during 2023-2030, the report said.

Europe will add 11 million subscribers between 2022 and 2030 — reaching 507 million by 2030. Unique mobile subscriber penetration in Europe will reach 92 percent of the population by 2030 – higher than North America and much higher than the global average (at 73 percent).

Within Europe, penetration rates are above 90 percent in most countries, with France reaching 96 percent, Germany 94 percent and the UK 93 percent by 2030.

Europe has more than 460 million people, who are connected to the mobile internet. The mobile internet usage gap is 14 percent in 2022. Most countries in Europe had mobile internet penetration rates above 60 percent as of 2022. Some countries, including Denmark, Italy, Spain and Portugal, have rates of more than 90 percent.

Europe will have more than 500 million licensed cellular IoT connections by 2030, driven by growth in the automotive and utilities sectors.

5G monetization

European operators are exploring diverse strategies to drive 5G monetization. Tariff structures moving away from volume-based pricing have gained traction, exemplified by Finland’s Elisa offering differentiated 5G plans based on mobile speed, resulting in a notable increase in average billing per user upon upgrading to 5G.

Additionally, the potential for 5G Fixed Wireless Access (FWA) is being recognized as an incremental revenue opportunity. Notably, countries with substantial legacy cable and xDSL connections, like Austria and Italy, have witnessed early successes in 5G FWA, presenting prospects for operators to meet burgeoning data demands.

The advent of 5G SA introduces capabilities crucial for monetizing 5G investments, particularly improved support for network slicing. Successful trials incorporating slicing, such as major event broadcasting and cloud gaming, underscore its potential in diversifying services and enhancing user experiences.

A pivotal transformation in telecom networks is underway to align with evolving connectivity needs and accelerate data-driven technologies like AI and web 3.0. Network softwarization, virtualization, and cloud-native architectures are being pursued alongside infrastructure investments to accommodate these evolving demands.

The shift from selling connectivity to orchestrating responsive digital infrastructure for developers signifies the evolving operator business model. As digital services demand more sophisticated networks, the focus is on empowering developers with enhanced capabilities to interact with these networks, heralding the next phase of innovation in telecommunications.