ETNO, the European Telecommunications Network Operators Association, has unveiled a report, crafted in collaboration with Analysys Mason, which calls on major technology corporations to contribute to the Capital Expenditure (Capex) required for the development of broadband and 5G networks across Europe.

In RAN technologies, Europe shows commitment to Open RAN, with 11 trials and developments in 2023, surpassing North America but falling behind Asia and Japan. The report highlights a shift in telecom operators’ spending patterns, revealing that, for the first time in 2023, external cloud and IT providers garnered more investment than in-house services, marking a significant departure from historical trends.

The report underscores the challenges faced by the European telecoms sector, emphasizing its underperformance in both revenue and investment. Operators grappled with absorbing inflation on behalf of customers, resulting in a decline in real revenue. European Average Revenue Per User (ARPU) lags behind global peers, with mobile and fixed broadband ARPU figures in 2022 notably lower than those in the USA, South Korea, and Japan.

A substantial portion of the rise in capex is attributed to the fiberization of fixed access networks, primarily FTTH (Fiber-to-the-Home), and continued investment in mobile RAN, especially in 5G. Fixed access accounted for almost half (48%) of all telecoms operator capex in Europe in 2022, with about 90% dedicated to FTTH. Mobile capex, accounting for 20-30%, remains evenly distributed and aligns with spectrum awards and network evolution.

The report also touches on the discrepancy between telecoms operators’ and tech giants’ investments in digital infrastructure, emphasizing the need for increased collaboration.

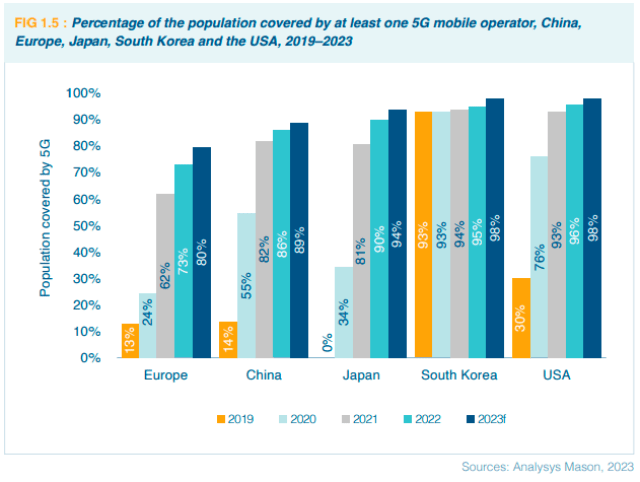

In the 5G arena, Europe trails behind global peers, reaching 80 percent of the population in 2023. Mobile downlink speeds and usage in Europe fall behind those in the USA, South Korea, and China. The report notes European operators’ substantial spending in spectrum auctions for 5G bands, reaching EUR 26 billion by October 2023.

Despite advancements, Europe still faces challenges in achieving gigabit connectivity, trailing behind China, South Korea, and the USA. The report points out that Europe’s FTTH coverage surpasses global peers but highlights a gap in reaching the EU Digital Decade Targets.

As the sector grapples with challenges, including fragmentation in retail markets, Europe’s telecom industry faces a decline in Return on Capital Employed (ROCE) and high capital intensity. The net debt/EBITDA ratio for ETNO members reached 2.60 in 2022, marking the highest in recent years, as the industry contends with rising costs and challenges in generating adequate returns.

In summary, the ETNO report calls for collaborative efforts to address the pressing challenges faced by the European telecoms sector, urging Big Tech to play a role in sharing the burden of Capex for critical network infrastructure development.