TIM S.A., a leading Brazilian telecommunications company, announced impressive financial results for the second quarter of 2023. The company’s revenue surged by 9.2 percent, reaching an impressive total of R$5,863 million.

In the Prepaid segment, revenue surged by an impressive 11.8 percent in 2Q23, with Prepaid ARPU reaching R$14.3 (+13.1 percent). The growth in Prepaid Revenue was primarily a result of increased recharges sell-out, reflecting the company’s successful strategy to monetize its customer base by offering service packages with exclusive content. Additionally, the reclassification of part of Oi’s customer base from the Control segment to the Prepaid segment also contributed to this growth.

The Postpaid segment also experienced significant growth, with Postpaid Revenue increasing by 10.5 percent in 2Q23. The Postpaid ARPU reached R$43.1 (+16.7 percent), and Human Postpaid ARPU reached R$51.8 (+18.7 percent). Remarkably, TIM achieved one of its lowest churn levels ever during this quarter, with only 1.1 percent per month, further solidifying its position in the market.

Fixed Service Revenue also witnessed substantial growth, rising by 6.5 percent and amounting to R$323 million in 2Q23. This growth was primarily driven by the success of TIM UltraFibra, the main driver of the fixed segment, which saw a significant increase of 10.1 percent during the quarter, reaching an ARPU of R$94.8 (+3.7 percent). The company’s focus on strengthening and expanding its ultra-broadband services offering played a vital role in this achievement.

The positive trend extended to Mobile ARPU, which experienced robust growth of 13 percent, reaching R$29.2 in the quarter. This accomplishment is in line with TIM’s strategic goal of increasing the monetization of its customer base, and over the first six months of 2023, MSR increased by an impressive 15 percent.

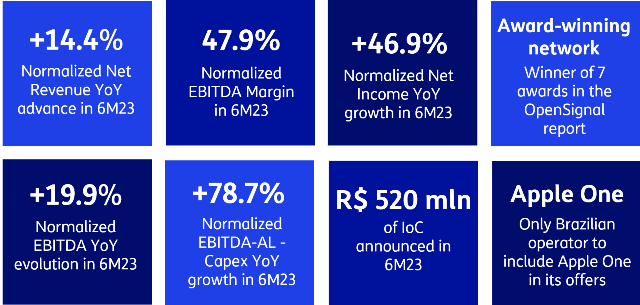

The company’s investments, represented by Capex, totaled R$926 million in 2Q23, showing a decline of 11.8 percent. The reduction in Capex was primarily due to lower investments in the Network line. In the previous year, TIM had increased these investments to prepare its infrastructure for the influx of new customers from Oi, as well as to facilitate the offloading of traffic from the 4G network to 5G. Consequently, the Capex over revenue ratio for 2Q23 was 15.8 percent, declining by 3.8 percentage points from the same quarter of the previous year. During the first six months of 2023, Capex fell by 6.9 percent.

Overall, TIM S.A.’s remarkable financial performance in the second quarter of 2023 reflects the company’s successful strategic approach and its continuous efforts to offer innovative and high-quality services to its customer base. The positive growth trajectory bodes well for the company’s future and reinforces its position as a prominent player in the Brazilian telecommunications industry.