Telenet Group Holding has revealed its Capex, revenue and Opex for the nine months ended September 30, 2022.

Telenet reported net profit of €996.1 million for the first nine months of 2022 thanks to gain on disposal of assets related to the TowerCo transaction as well as a significantly improved financial result due to a non-cash gain on derivatives.

Telenet revealed that its operating expenses rose 3 percent in the first nine months of 2022, reflecting higher energy prices and staff-related costs impacted by mandatory wage indexation.

“We will switch off the 3G signal on our mobile network in two years’ time, as of September 2024. By freeing up the network capacity of the older 3G signal and using it for 4G and 5G, we can offer our customers more capacity, stability and higher speeds,” John Porter, Telenet’s Chief Executive Officer, said.

Capex (capital expenditures) for the first nine months of 2022 reached €1,203.4 million and included the recognition of the mobile spectrum licenses and the tower lease.

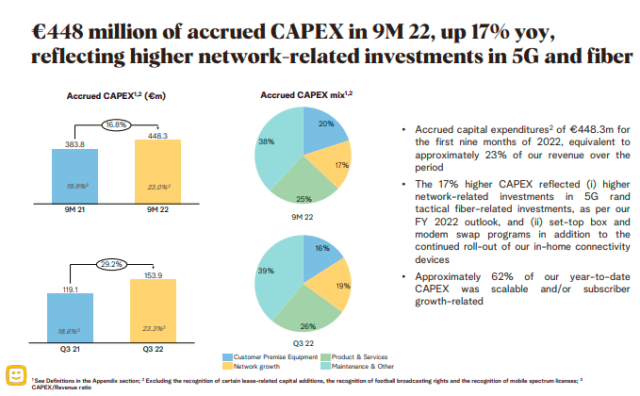

Telenet said capex, excluding the football broadcasting rights, mobile spectrum licenses and lease-related capital additions impacts, were €448.3 million, equivalent to 23 percent of revenue, up 17 percent.

Telenet capital expenditures related to customer premises equipment, which includes spending on set-top boxes, modems and WiFi powerlines represented €89.4 million for the nine months ended September 30, 2022 (Q3 2022: €23.9 million).

Capital expenditures for network growth and upgrades amounted to €74.9 million for the first nine months of 2022 (Q3 2022: €28.5 million), marking a 61 percent increase compared to the prior year period and predominantly reflected the start of 5G roll-out and fiber investments.

Capital expenditures for products and services, which reflects investments in product development and the upgrade of IT platforms and systems, totaled €111.9 million for the first nine months of 2022 (Q3 2022: €39.6 million).